Estate planning

Estate & Legacy Planning

"I am struggling to care for my family, so this money would have been a great relief for my family. But now, it is all gone."

Estate Planning:

To give your money and property and assets to those who you care for.

If you have a will, you have done up half of your estate planning. If you have not, you have also done up half, as you have given the government the right to distribute your assets the way you MAY NOT want it.

If you did not make a will:

Why?

Things we do:

Wills Writing

Trust set up

Lasting Power of Attorney (LPA)

Advanced Medical Directive (AMD)

Advanced Care Planning (ACP)

For business owner:

Shareholder Agreement

Business Trust

We’ll guide you every step of the way

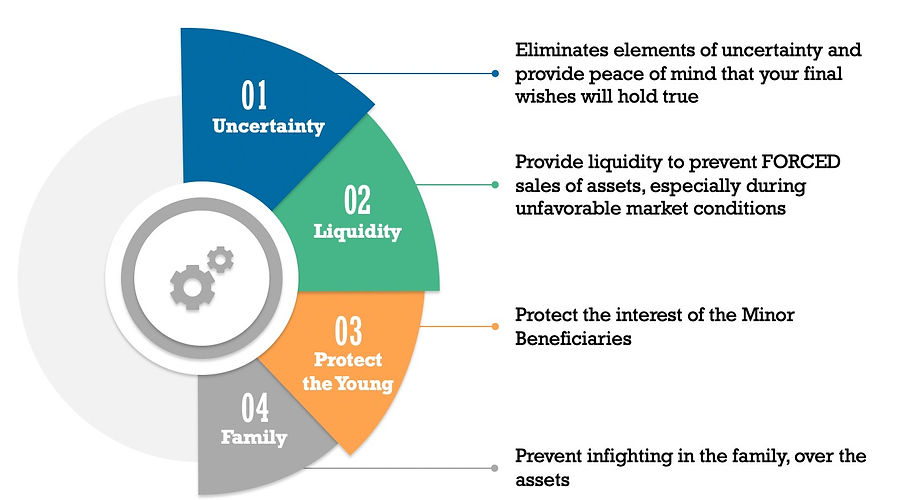

Things to lookout for:

Why work with us:

Personal; we understand you before we embark on our planning, we only work with clients who is ready

Professional; Our Estate Planner have all went through rigorous training curriculum before they are even allowed to start advising client on Estate Planning and are interned with experienced Practitioner who show them the rope on proper planning.

Practical; would you trust the guy who tell you to eat porridge everyday so that you can have your lobster everyday when you retire? Same goes for us, we don’t believe nor give advice like asking you to scrimp and save just so your family can have a better life after your gone. Estate Planning is about being enjoying your current lifestyle without compromising your family future.